Get in touch with us today!

If you have any questions, enquiries or just want to say how much you like us (or what we can do better), please drop us a line.

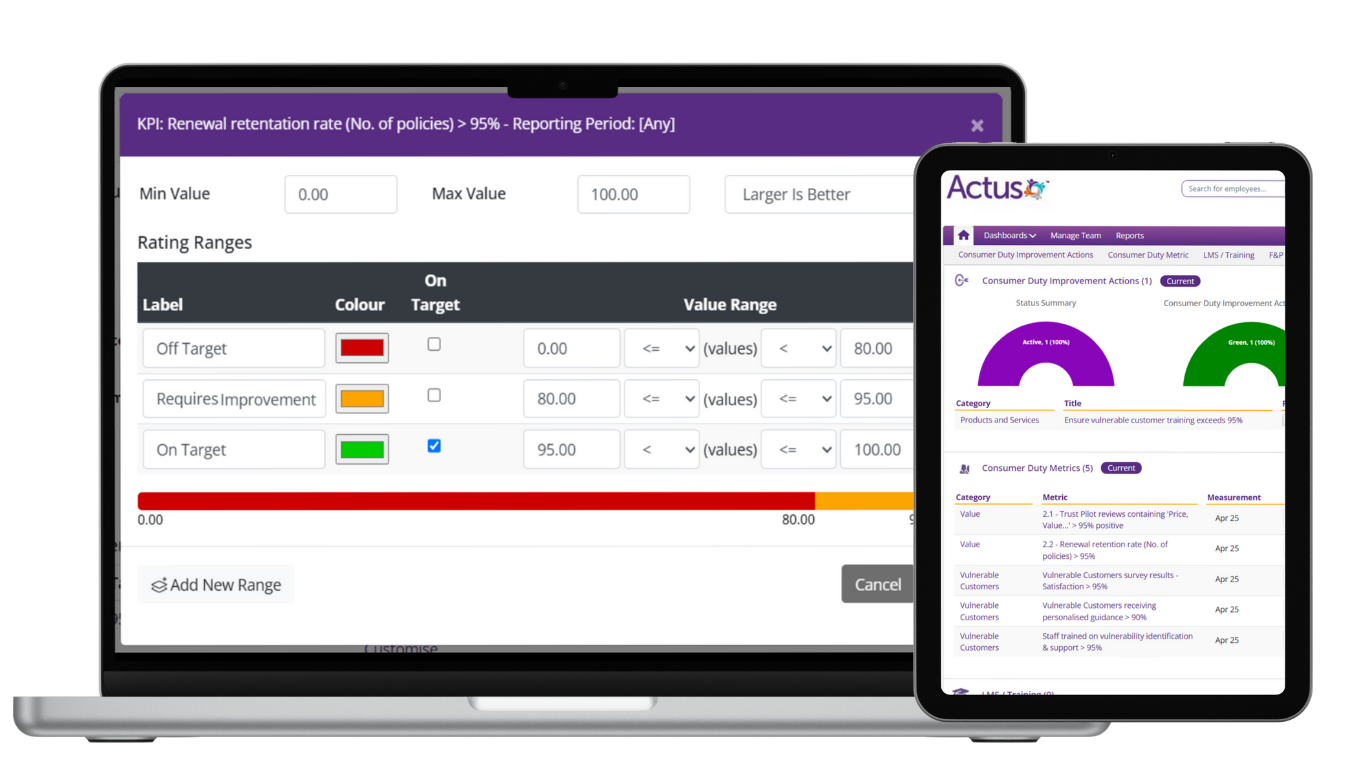

Actus offers two powerful modules to meet FCA and Central Bank regulations with confidence:

By automating ownership, tracking key performance metrics, and delivering real-time compliance dashboards, the software streamlines processes, reduces manual admin, and saves valuable time. With clear visibility across all levels of the organisation, Actus Oversight makes compliance not just easier—but more efficient, cost-effective, and business-friendly

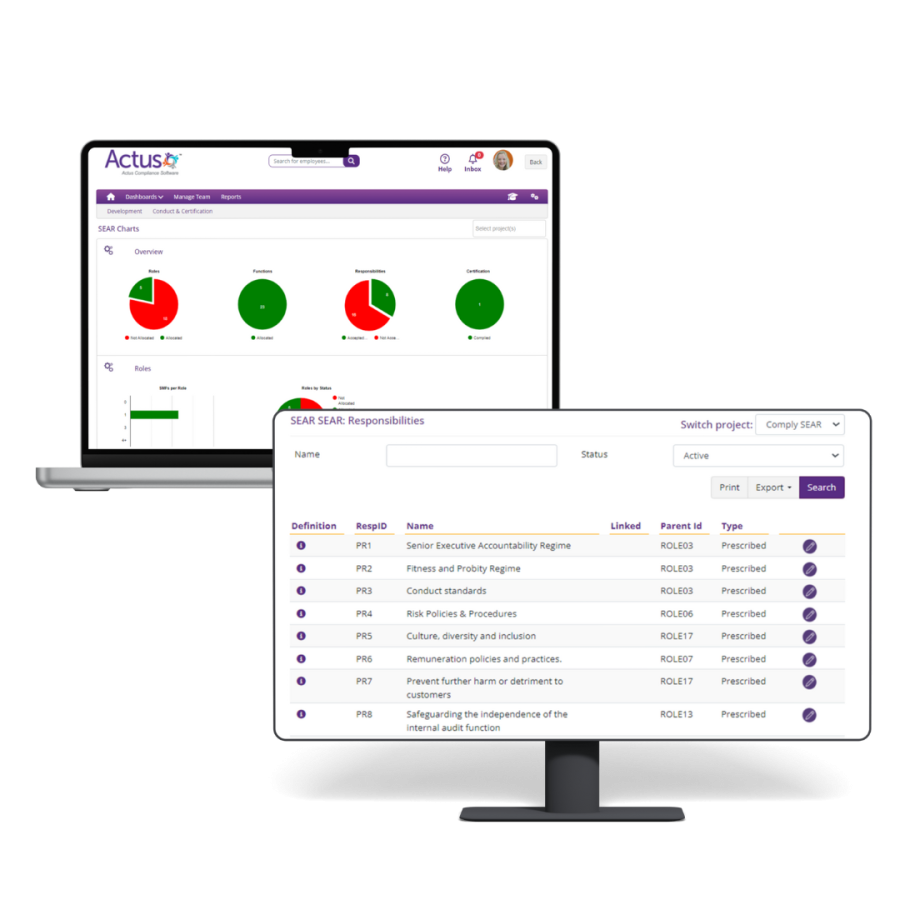

Actus Oversight – Find out moreUsed by 10,000+ professionals, Actus Comply simplifies SMCR, SEAR, and Fitness & Probity management.

Purpose-built for financial services, it tracks responsibilities, provides a full audit trail, produces responsibility maps and automates Fitness and Probity—helping you meet FCA and CBI requirements with less admin and greater peace of mind.

See Actus Comply

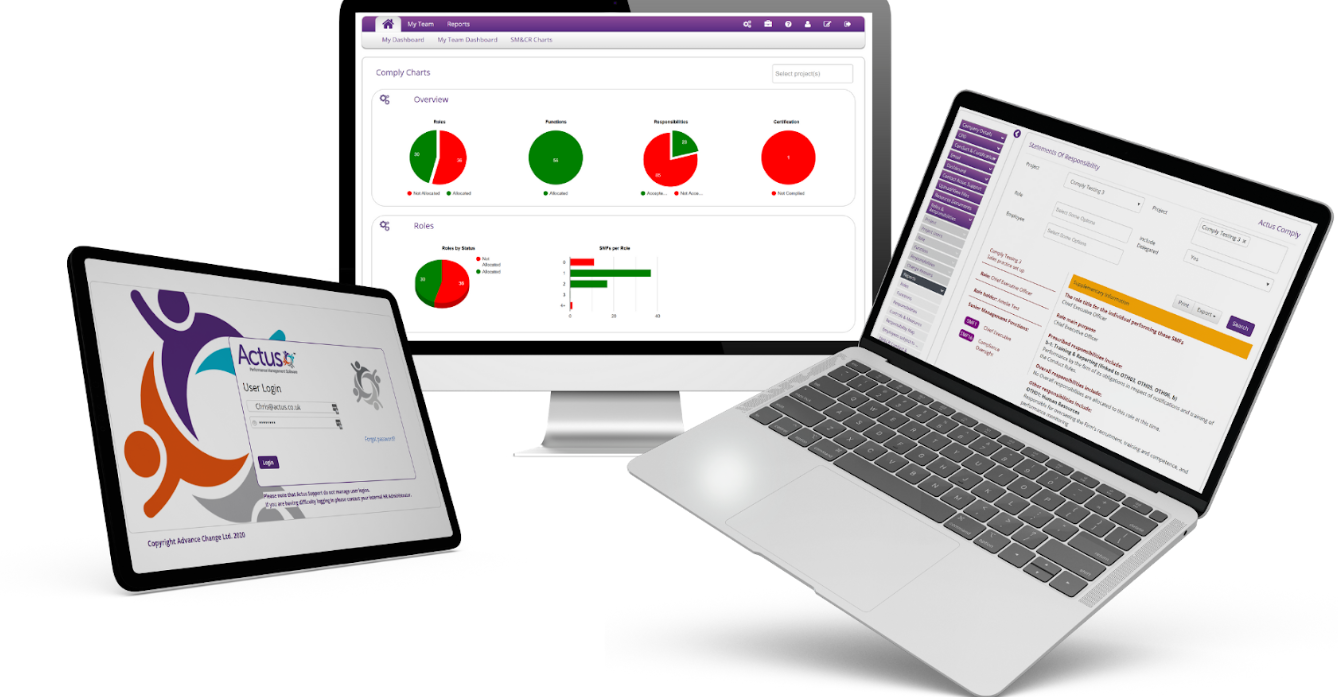

Actus delivers powerful, integrated software for compliance, performance, learning, and talent management—helping financial firms engage employees, develop leaders, and thrive in a regulated world

From Consumer Duty and SMCR to performance reviews and learning pathways, Actus is trusted across the financial services sector to drive accountability, boost efficiency, and build high-performing, compliant cultures

Actus Compliance – Affordable. Effective. Assurance you can trust

Discover how Actus can simplify compliance and unlock performance for you.

From expert implementation to dedicated account management, Actus is with you from day one and beyond.

Our experienced team ensures your system goes live smoothly—tailored to your needs and fully supported with clear guidance and communication.

Once you’re up and running, your dedicated Account Manager is on hand with regular service reviews, usage insights, and added value through webinars, resources, and expert advice.

Need help? Our UK-based support desk is rated 5/5 for responsiveness and reliability, backed by strong SLAs and fast resolution times.

Actus Perform offers powerful add-on modules for performance management, appraisals, learning, and talent development—all seamlessly integrated into a single, cost-effective platform.

Designed to grow with your business, these modules extend your compliance solution into a unified HR system—streamlining processes, improving oversight, and boosting efficiency across your workforce.

One platform. Full visibility. Better results.

Please complete the details to receive a 3 minute system tour direct to your inbox!

If you are looking for performance management software for 1000+ employees get in touch for a quote today.

Talk to one of our partnership specialists today.

Fill in your details below and then please check your email for a link to the 3 minute overview of Actus Software

If you have any questions, enquiries or just want to say how much you like us (or what we can do better), please drop us a line.